Uncovering what counts

Hear from Private Wealth Advisor Kim Shores on why she feels less talking and more listening is the key to understanding what matters most.

Q. Can you tell us a little bit about how advisors approach advice and planning with clients that are a part of The Private Bank experience?

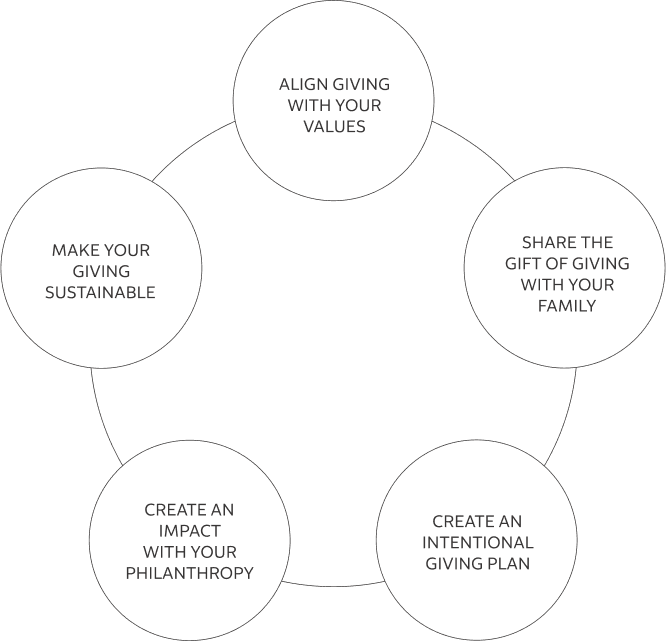

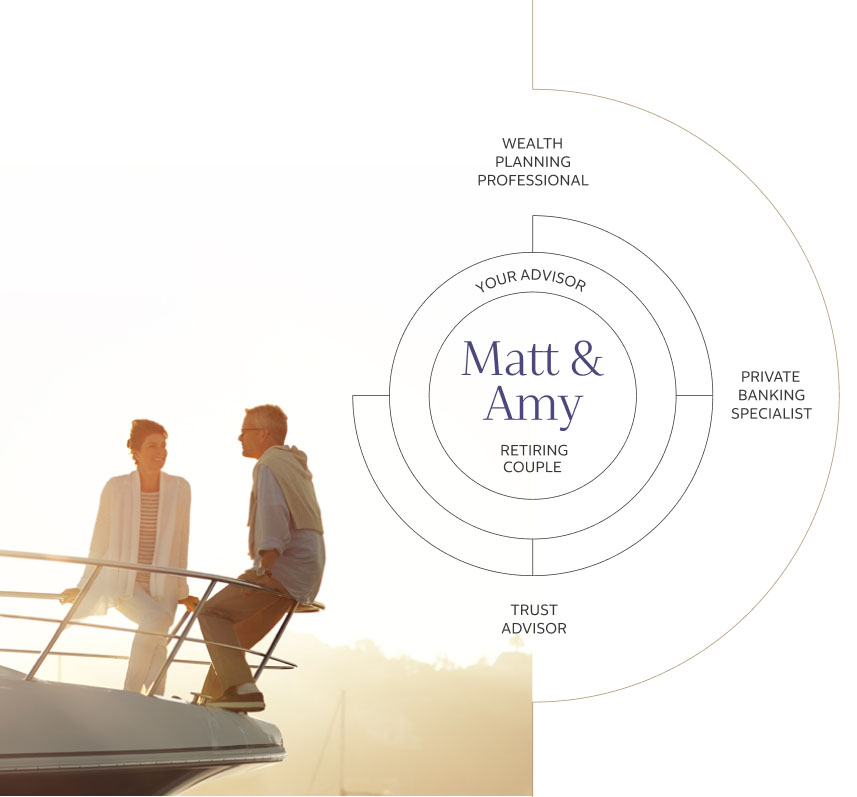

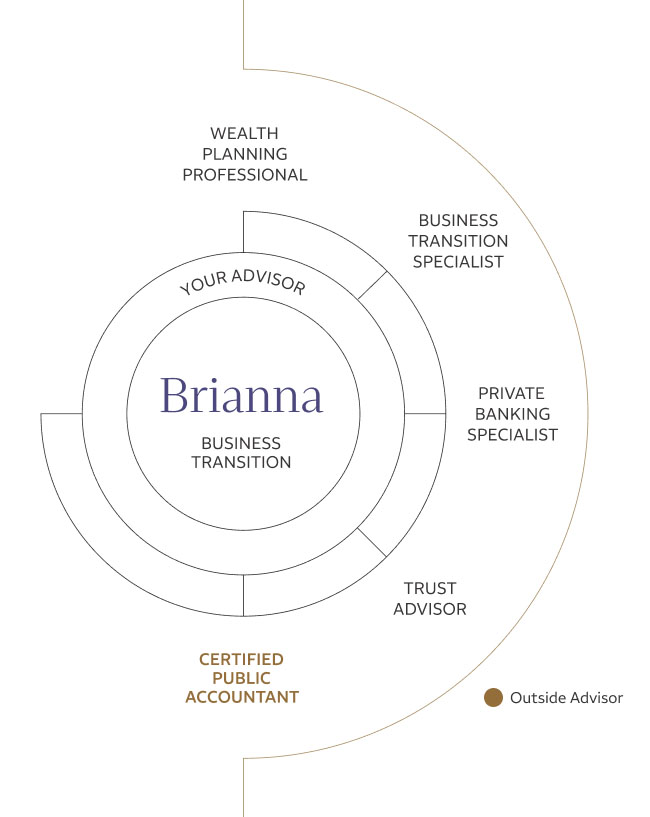

Kim: Sure. We call it LifeSync®. We sit down, ask a lot of questions, and dig into our client's circumstances. We want to define and crystallize their goals, and what’s driving them. From there, we pull together the tools and a team focused around the client and their specific needs and values, so we can offer a personalized wealth experience. It’s about creating a unique connection with our client’s life and their financial journey. It is the basis of how we work.

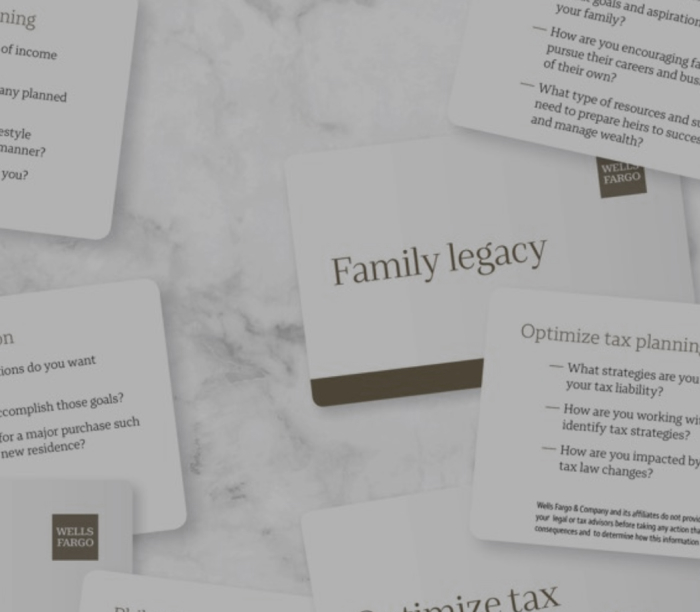

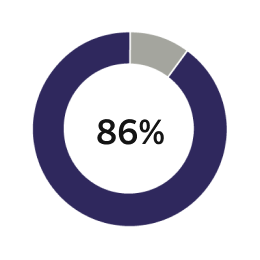

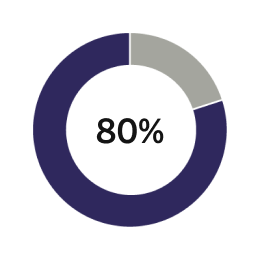

Say parent values are the most vital to inherit

Say parent values are the most vital to inherit Rarely or never talk with parents about money and its role in their lives

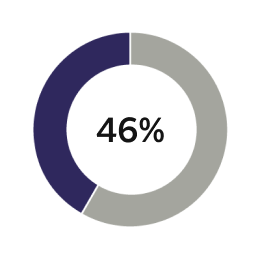

Rarely or never talk with parents about money and its role in their lives Believe regular meetings about finances would be helpful

Believe regular meetings about finances would be helpful